MUA Working Waves 2023

Reliance Bank has sponsored the annual MUA Working Waves event for over 20 years. This surfing competition is held over a single day at Norah Head, a surf beach on the Central Coast of NSW and is organised through the MUA Newcastle Branch. It is always enthusiastically supported by members and sponsors, with some competitors travelling from interstate.

The MUA retired members have the “Barbie” going all day and it is a great event for MUA members, family, and friends.

This year was again a fantastic day out with amazing weather, and fun had by all.

Bank Impersonation Scams

We'd like to draw your attention to the increasing number of bank impersonation scams in Australia, which have been growing in sophistication and complexity.

How strong passwords can help protect your money

There are several reasons why using strong passwords to protect your money is crucial. With the rise of cybercriminals over the last few years, providing an extra layer of security is essential to prevent unauthorized access to sensitive financial information. Strong passwords are more difficult for hackers to guess or crack, making it more difficult for them to access your account.

A strong password should contain a combination of uppercase and lowercase letters, numbers, and special characters and be at least 8-12 characters long. It should also be unique and not easily guessable by others.

If a weak password is used, it can be easily cracked by automated password guessing tools or by hackers who use social engineering tactics to guess or obtain passwords. This can lead to unauthorized access to your bank account, allowing hackers to steal your money or personal information.

Therefore, using strong passwords is an essential step in protecting your financial security and keeping your sensitive information safe.

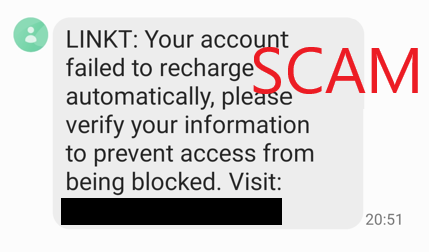

Latest Scam Alert: Linkt Scams

We are urging our Members to be wary of messages impersonating Linkt (QLD Toll Road Provider) requesting your card details to make a payment or update your details by clicking a link, most often contact is made through SMS and WhatsApp. These are phishing scams designed to steal your credit card details and then used to set up a digital wallet, such as Apple Pay or Google Pay operated by a scammer.

To protect yourself from these scams, please follow the advices from ACCC.

- Do not click on any links in unexpected messages. Even if you expect a message, it is best to access the information directly from a website or a source you have found independently.

- Pay attention to typos or grammatical mistakes in the text message. Delete the message and do not respond.

- If you think you have an unpaid bill, contact the company separately through their legitimate channels.

- Do not reply to the message. Delete and block the number.

If you are concerned about the security of your account or believe you have been scammed, contact us immediately on 13 24 40.

Free Bank@Post Withdrawals

From 1 January 2023 Reliance Bank members including business account holders will no longer have to pay a fee to withdraw funds using the Bank@Post service available at over 3,100 Post Offices throughout Australia.

For Members without easy access to one of our branches or a nearby ATM, banking at the local post office provides a convenient alternative. Until now a $2.60 fee ($3 for Business Accounts) has applied for withdrawals to cover the cost of Australia Post providing the service. From 1 January 2023 this cost will now be absorbed by the Bank, and the withdrawal fee removed.

Click here to learn more about Bank@Post facilities. You can access the Fees and Charges Transaction Limit Document here.

More Articles...

Page 3 of 5